Bitcoin ETFs have become the new rave of the moment. Literally everyone, from finance professionals to the cashier at your convenience store is talking about bitcoin ETFs.

So, what exactly are bitcoin ETFs and how do they differ from regular Bitcoins? In this article, we will take a close look at what Bitcoin exchange-traded funds are, the different types of Bitcoin ETFs, and what differentiates them from actual Bitcoins.

But first, let’s start with understanding what ETFs are and how they work.

How does an ETF work?

An ETF, or Exchange-Traded Fund, is simply a tradable security that tracks the performance of a specific index, sector, commodity, bond or basket of assets.

ETFs give investors exposure to the price movement of multiple publicly-traded companies, commodities, or indexes through a single investment. This type of investment vehicle functions much like a basket of securities that trades as a single asset.

To illustrate, suppose there is an ETF that consists of stocks from 10 different companies. By buying a share of that ETF, you own a fraction of each of those companies’ stocks.

Think of an ETF as a separate asset set up for the sole purpose of mirroring price fluctuations in other assets (or collections of assets) so that an increase in the price of the underlying asset results in an almost proportional rise in the price of the ETF.

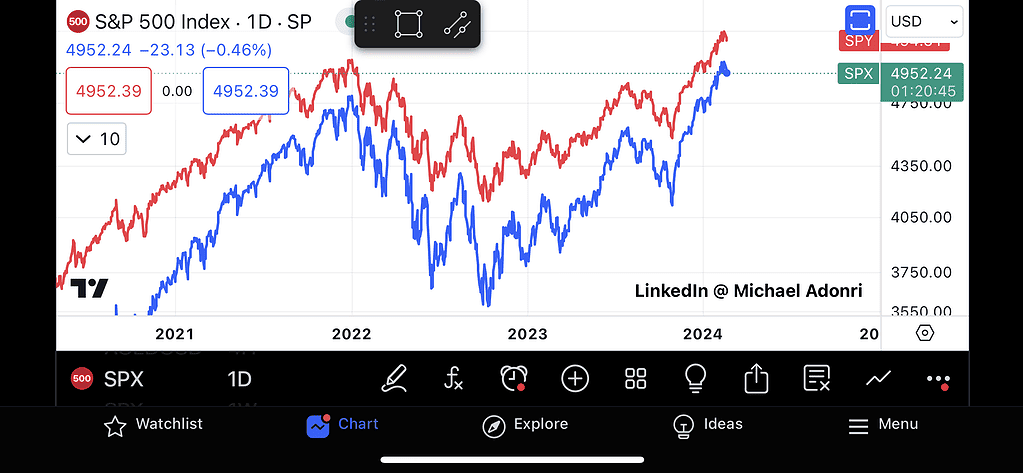

The SPDR S$P 500 Trust ETF is an exchange-traded fund that tracks the performance of the Standard and Poor’s 500 Index and you can see from the chart below that, while it (red line) trades at a fraction of the underlying index’s price, its price movement closely resembles that of the S&P 500 (blue line).

What is a Bitcoin ETF

A Bitcoin ETF is an investment vehicle that tracks the performance of Bitcoin. In the previous section, we discussed how typical ETFs worked. Well, in this scenario, Bitcoin is held within a fund or portfolio, with investors acquiring fractional ownership or shares of the fund.

Giving them the opportunity to benefit from Bitcoin’s price fluctuations without being exposed to the actual asset. In the following section, we will delve into the various types of Bitcoin ETFs, aiming to provide readers with a comprehensive understanding of their functionality and operation.

A Bitcoin ETF is an investment vehicle that tracks the performance of Bitcoin.

theDeFiMovement

What are the types of bitcoin ETFs

The term “Bitcoin ETF” surged in popularity around October 2023, ranking among the most trending topics at the time. However, what some cryptocurrency enthusiasts might not realize is that Bitcoin ETFs have existed even before this frenzy.

Below, we take a look at the two different types of Bitcoin ETFs; Futures-based Bitcoin ETF and Spot Bitcoin ETFs.

What is a Bitcoin Futures ETF

Imagine a contract that obligates you to buy or sell a certain asset at a predetermined price and future date. That’s the essence of a futures contract.

In the context of Bitcoin, a futures contract specifies the price at which you’ll buy or sell Bitcoin at a particular point in time, say, six months from now.

So, What’s a Bitcoin Futures ETF?

A Bitcoin futures ETF is a type of exchange-traded fund (ETF) that allows investors to gain exposure to Bitcoin futures contracts. Unlike traditional ETFs that hold physical assets like stocks or commodities, a Bitcoin futures ETF holds futures contracts linked to the price of Bitcoin.

These futures contracts allow investors to speculate on the future price of Bitcoin without actually owning the cryptocurrency itself. Instead, they are betting on whether the price of Bitcoin will rise or fall within a specified time frame.

The first Bitcoin Futures ETF (BITO) was approved in October 2021, almost three years before its Spot counterpart was approved by regulators.

What is a Spot Bitcoin ETF

“Spot” refers to the immediate or current market price of an asset. So, a spot Bitcoin ETF would invest in actual Bitcoin, holding it directly within its basket of assets.

Unlike futures-based Bitcoin ETFs, which derive their value from futures contracts, a spot Bitcoin ETF holds physical Bitcoin. This means that investors in a spot Bitcoin ETF are directly exposed to the price movements of Bitcoin itself, rather than the price of Bitcoin futures.

Unlike futures-based Bitcoin ETFs, which derive their value from futures contracts, a spot Bitcoin ETF holds physical Bitcoin

theDeFiMovement

Spot Bitcoin ETF news have been in the news for quite some time. The Winklevoss twins were the first to propose the idea of an investment fund that tracked the performance of Bitcoin in 2013 (this was just four years after the first BTC was mined).

However, due to regulatory hurdles, spot bitcoin ETFs never got the green light to trade on security exchanges. Not until January 10, 2024 when regulators from the SEC approved the first 11 spot bitcoin ETFs.

Is it a good idea to invest in a bitcoin ETF?

Whether or not investing in Bitcoin ETFs is a good idea depends on a lot of factors. While ETFs limit an investor’s exposure to the price fluctuations of certain securities, they are not entirely foolproof.

These investment funds mirror the performance of existing securities, which means that they are still susceptible to market volatility. If, for instance, the S&P Index drops by 1% in a single trading day, any ETF tracking the index (e.g the SPDR Trust ETF) will experience an almost proportional decrease in value during that same period.

This same rule applies to Bitcoin ETFs.

It’s also worth noting that investing in Bitcoin ETFs attracts fees. Fund managers typically charge a management fee for holding and securing Bitcoins held in a fund.

The fees for managing these funds can differ depending on the fund manager. Below is a comprehensive list of approved Bitcoin ETFs since January 2024, along with their respective management fees;

| Bitcoin Exchange-Traded Fund (Ticker) | Management Fee |

| Franklin Bitcoin ETF (EZBC) | 0.19% |

| ARK 21Shares Bitcoin ETF (ARKB) | 0.21% |

| VanEck Bitcoin Trust (HODL) | 0.25% |

| iShares Bitcoin Trust (IBIT) | 0.25% (fees waived to 0.12% for the first 12 months or until $5 billion in AUM) |

| Invesco Galaxy Bitcoin ETF (BTCO) | 0.25% (fees waived to 0.00% for the first 6 months) |

| Valkyrie Bitcoin Fund (BRRR) | 0.25% |

| Fidelity Wise Origin Bitcoin Trust (FBTC) | 0.25% |

| Hashdex Bitcoin ETF (DEFI) | 0.90% |

| Bitwise Bitcoin ETF (BITB) | 0.20% (fees waived to 0.00% for the first 6 months or until $1 billion in AUM) |

| Grayscale Bitcoin Trust (GBTC) | 1.50% |

So, are Bitcoin ETFs worth it?

Determining the viability of a Bitcoin ETF will ultimately depend on an investor’s goals and risk tolerance. It’s important that investors carry out their own research and assess the profitability, and potential risks, associated with investing in Bitcoin ETFs.

How to invest in a Bitcoin ETF

Investing in Bitcoin ETFs is easy. You can trade them on regular exchanges or purchase them from trusted brokerage firms.

Below are the steps you need to follow to purchase Bitcoin ETFs from brokerage companies;

Step 1: Open a brokerage account. Not all brokerages offer access to Bitcoin ETFs. Some of the online brokers that do include Robinhood, Interactive Brokers, Fidelity, eToro, etc.

Step 2: Fund your newly-created account.

Step 3: Search for the Bitcoin ETF you want to invest in using its name or ticker symbol (the abbreviations enclosed within parentheses in the table above).

Step 4: Enter the number of shares you want to buy and place an order.

Step 5: Monitor your investment.

The process of investing in Bitcoin ETFs may not always be as simple as the steps we outlined above. Some platforms are easier to navigate than others.

This is why it’s important that investors first familiarize themselves with a broker’s trading platform before funding their account.

Best Bitcoin ETFs

| ETF Name | Expense ratio | Assets Under Management (AUM) | Type of Bitcoin ETF they invest in |

| Invesco Galaxy Bitcoin ETF (BTCO) | 0.0% | $300 million | Spot Bitcoin ETF |

| Bitwise Bitcoin ETF (BITB) | 0.0% | $623.1 million | Spot Bitcoin ETF |

| iShares Bitcoin Trust ETF (IBIT) | 0.12% | $2.7 billion | Spot Bitcoin ETF |

| ProShares Bitcoin Strategy (BITO) | 0.95% | $1.8 billion | Futures-based Bitcoin ETF |

| Grayscale Bitcoin Trust (GBTC) | 1.50% | $28.6 billion | Spot Bitcoin ETF |

What is the difference between bitcoin ETF and bitcoin?

Bitcoin is a cryptocurrency while a Bitcoin ETF is an asset that tracks the performance of Bitcoin. When you buy Bitcoin from an exchange, your tokens get stored in a cryptographically protected virtual wallet.

This means that you store and manage the tokens in that wallet. A Bitcoin ETF, on the other hand, doesn’t operate like that.

When someone invests in a Bitcoin ETF, they’re essentially purchasing the right to own a share in that fund’s pool. These investors don’t store or manage the Bitcoins in the pool; instead they earn profits based on the shares they own.

What are the advantages of Bitcoin ETFs

Now that we’ve discussed what Bitcoin ETFs are and if they’re a worthwhile investment, it’s time to delve into the benefits of these bitcoin-tracking funds.

1) Bitcoin ETFs provide accessibility to Bitcoin without direct ownership

2) Bitcoin ETFs are a regulated investment

3) Bitcoin ETFs provide a good opportunity for investors to diversify their portfolios

4) Asset managers provide a transparent report of investors’ holdings

Is it better to buy bitcoin ETF or bitcoin?

When choosing between Bitcoin and Bitcoin ETFs, there really isn’t a “better” investment. It all just depends on the investor’s goals and risk appetite.

Bitcoin ETFs are regulated by the SEC. Bitcoin (the crypto) on the other hand isn’t registered as a legal asset

theDeFiMovement

Bitcoin trades 24 hours a day for 365 days while Bitcoin ETFs only trade during market hours (usually between 9:30 a.m. and 4 p.m., Mondays to Fridays). Also, as discussed earlier, bitcoin ETFs are regulated by the SEC. Bitcoin (the crypto) on the other hand isn’t registered as a legal asset.

These, and a host of other factors, are some of the things an investor should keep in mind before deciding which Bitcoin investment is best for their portfolio.

FAQs

Can I buy ETF on Binance?

No, you can’t buy Bitcoin ETFs on Binance. Binance is a cryptocurrency exchange that allows users to purchase actual Bitcoin and engage in multiple types of cryptocurrency trading.

Does Fidelity have a Bitcoin ETF?

Yes, Fidelity Investments owns a Bitcoin exchange-traded fund. The ETF was approved on January 10, 2024 under the name “Fidelity Wise Origin Bitcoin Fund” and its ticker symbol is “FBTC”.

Will BTC go up after ETF?

Whether or not the price of Bitcoin will go up on news that spot ETFs have finally been approved depends on several factors. However, it’s worth noting that the availability of this kind of asset exposes Bitcoin to a newer, maybe even richer, kind of investor.

What is the lowest cost bitcoin ETF?

Currently, the lowest cost bitcoin ETF is the Invesco Galaxy Bitcoin ETF (BTCO) which has an expense ratio of 0.25%.